4.2 Q7: Time Analysis by LSTM

Can time series modeling reveal a predictive link between the sentiment and buy signals in Reddit discussions about Dogecoin and its price trends, enabling us to forecast future movements based on online discourse?

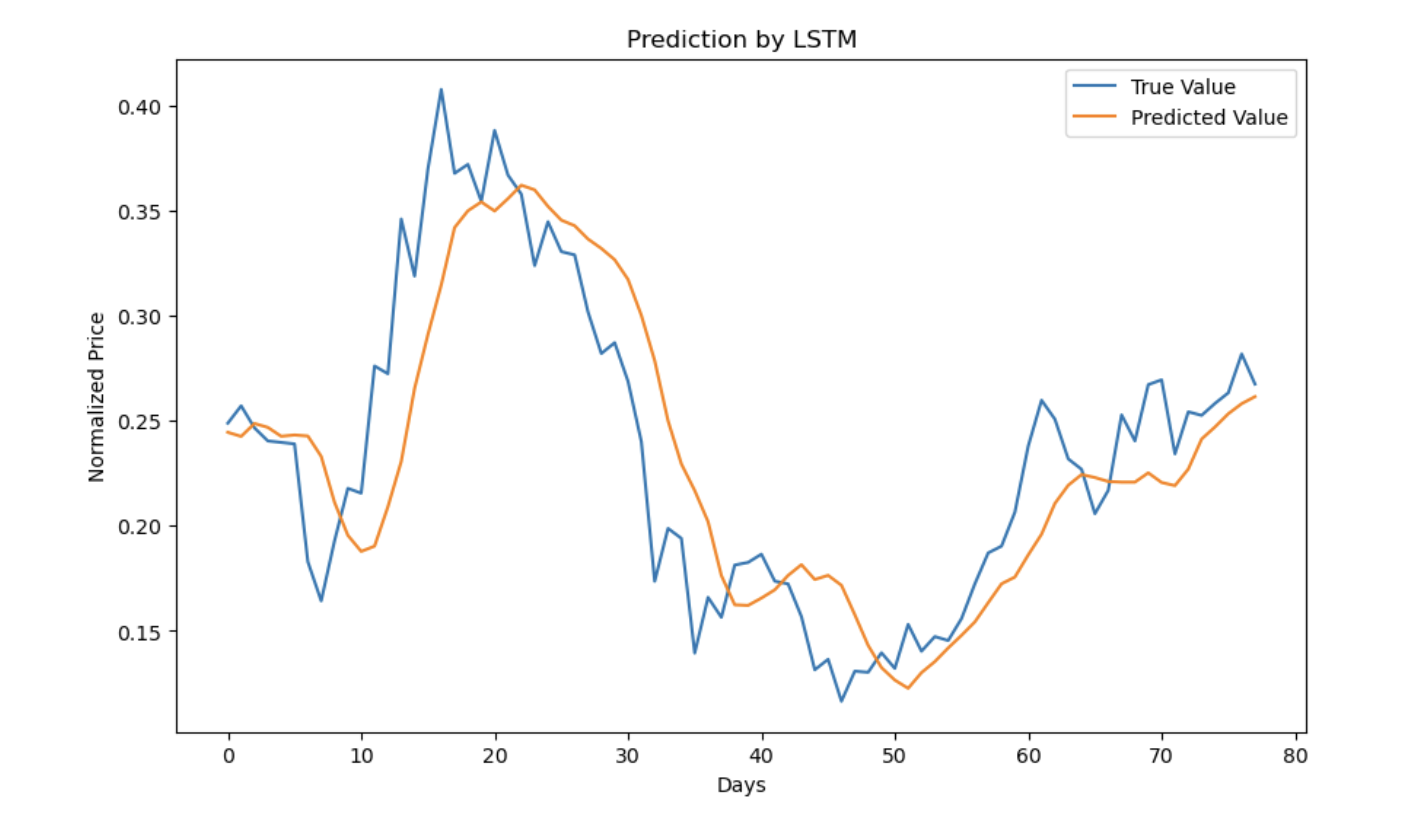

We attempt to predict the price of dogecoin using LSTM (Long Short-Term Memory). LSTM is a type of Recurrent Neural Network that is well-suited for time-series analysis and capable of understanding temporal relations in the data. We use a window of data to predict future data. In our attempt, we extracted the positive, negative, and neutral sentiment scores from a sample of the data and used them as features for the model. Consequently, the closing price, positive, negative, and neutral sentiment scores along with the number of posts and comments were used to predict the closing price of Dogecoin. Using a window of 7 days of data to predict, we make predictions and compare them to the original value. From the plot of predictions versus the original values, we can see that the model is capable of making close predictions with some lag to the trajectory traced by the original values. The model has an R^2 of 71.2%. This was higher than other window sizes of 10, and 21.